How to Become a Millionaire: The Realistic Roadmap (2026)

- 05 Jan, 2026

In this article

- 1. The Millionaire Math: Why Time Matters More Than You Think

- 2. The Three Paths to $1 Million (Choose Your Strategy)

- 3. The Income Optimization Playbook: Earning More Matters

- 4. The Investment Strategy That Actually Works

- 5. The Millionaire Savings Rate: How Much to Invest

- 6. The Wealth-Building Habits That Separate Millionaires From Everyone Else

- 7. The Millionaire Timeline: Real Scenarios Based on Income

- 8. What Could Go Wrong (And How to Handle It)

- 9. The Boring Truth About Becoming a Millionaire

- 10. Your First Move: The 30-Day Millionaire Kickstart

- 11. Time to Stop Reading and Start Building

- 12. Keep Building Your Wealth Strategy

You’re making decent money. $60K, maybe $80K, maybe even six figures.

Bills get paid. You’ve got some savings. From the outside, you’re doing fine.

But here’s the thing—you’re not building wealth. You’re just… existing.

And that number—$1 million in net worth—feels like it belongs to tech founders, inheritance kids, or people who bought Bitcoin in 2010. Not someone who clocks in at 9 AM and checks email until 6 PM.

I get it. I started $16K in the hole on a $45K salary. The idea of becoming a millionaire felt like a joke. But here’s what actually happened: I went from negative net worth to $13K saved in year one. Now I’m past $200K and climbing.

The path to $1 million isn’t a secret. It’s not complicated. But it does require understanding the actual math, making strategic moves, and having patience while compound growth does its thing.

This is the realistic roadmap—no get-rich-quick schemes, no crypto gambling, no “just start a business and hustle.” Just the boring, proven strategies that actually work for people with regular jobs.

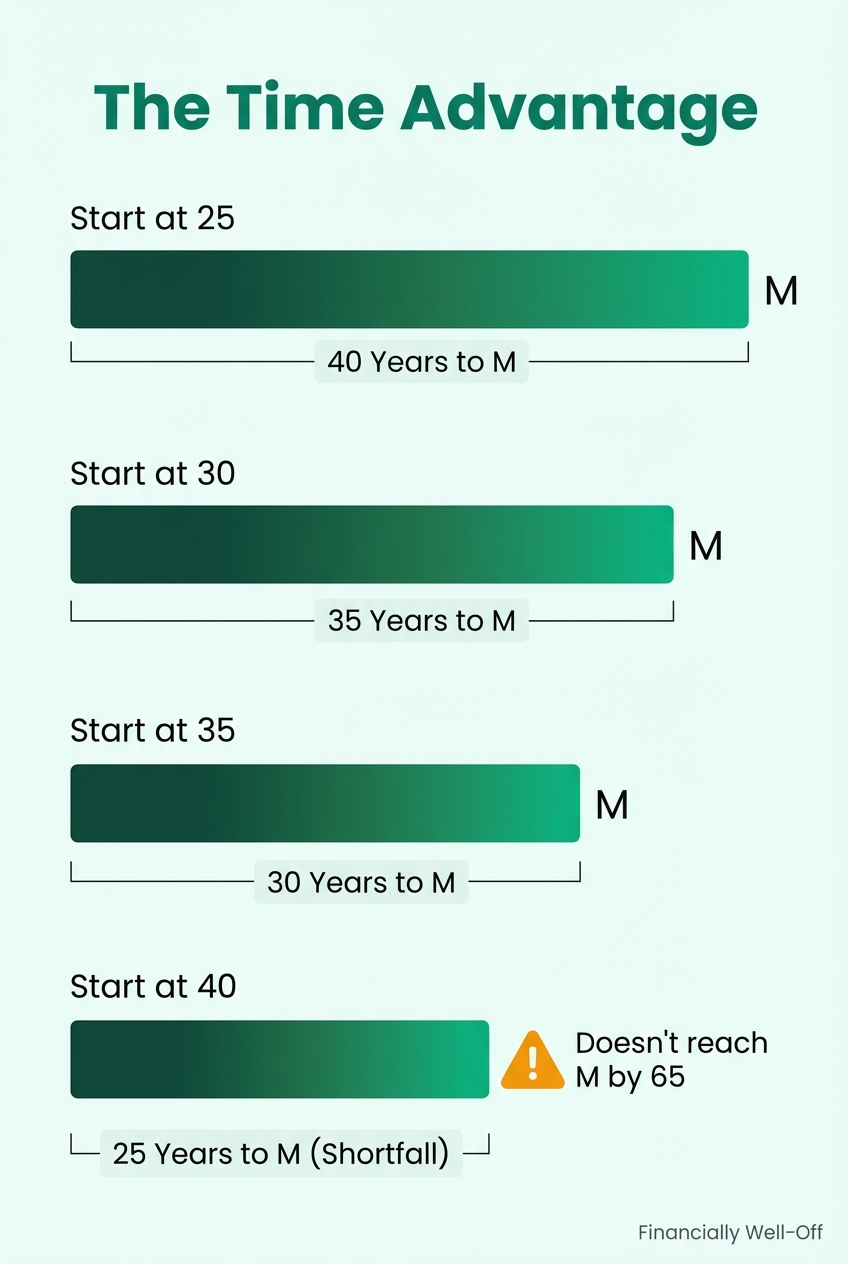

The Millionaire Math: Why Time Matters More Than You Think

Let’s start with the uncomfortable truth: becoming a millionaire is easier at 25 than at 45.

Not because you need to be young. Because you need time for compounding to work its magic.

Here’s what $1,000/month invested looks like at 8% annual returns:

| Starting Age | Years to $1M | Total Contributed | Investment Growth |

|---|---|---|---|

| 25 | 32 years (by 57) | $384,000 | $616,000 |

| 30 | 35 years (by 65) | $420,000 | $580,000 |

| 35 | 39 years (by 74) | $468,000 | $532,000 |

| 40 | Never reaches $1M | $300,000 by 65 | Only $464,000 total |

Notice the pattern? The longer you wait, the more money you have to contribute yourself because you’re giving up compounding years.

But here’s the good news: You can speed this up dramatically by increasing your investment amount. Here’s what happens if you invest more:

| Monthly Investment | Years to $1M (at 8% return) |

|---|---|

| $500 | 43 years |

| $1,000 | 32 years |

| $1,500 | 27 years |

| $2,000 | 24 years |

| $3,000 | 20 years |

See the gap between $1,000 and $2,000? That extra $1,000/month cuts 8 years off your timeline. That’s the real game—not just investing, but investing more.

The formula that actually matters:

Millionaire status = (Income × Savings rate) + (Investments × Time × Returns)

You can’t control market returns. You can’t manufacture extra years. But you can absolutely control your income and savings rate.

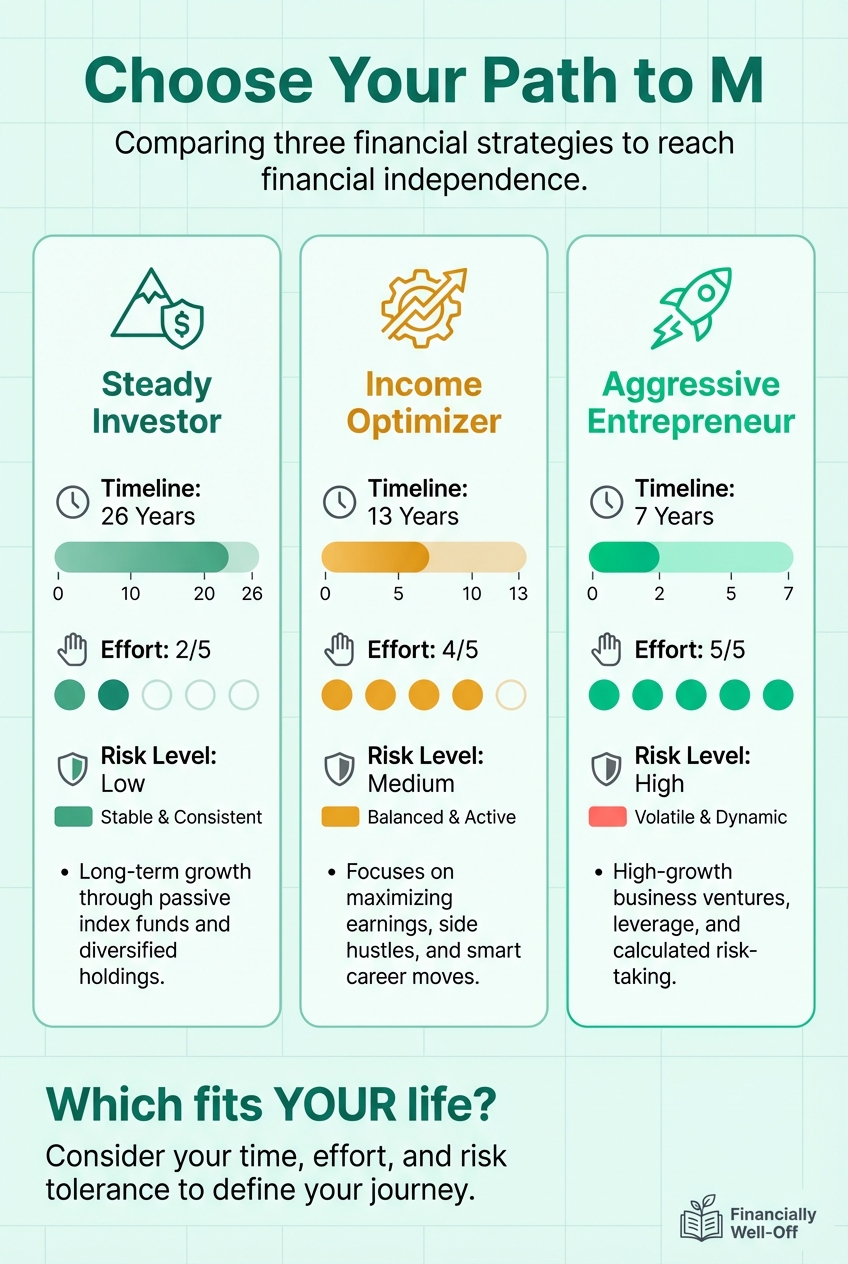

The Three Paths to $1 Million (Choose Your Strategy)

There’s no single way to build a million-dollar net worth, but every successful path falls into one of three categories. Pick the one that fits your situation:

Path 1: The Steady Investor (Most Common)

Who it’s for: People with stable W-2 income who want to build wealth without taking big risks

The strategy:

- Max out tax-advantaged accounts (401k, IRA, HSA)

- Invest in low-cost index funds (like VTSAX or VTI)

- Live on less than you earn and automate the rest

- Stay consistent for 20-30 years

Real example: Starting at age 30 with $10K already saved, investing $1,500/month at 8% average returns gets you to $1M by age 56. That’s 26 years of boring, consistent investing.

Pros: Low stress, proven to work, tax advantages Cons: Slow, requires discipline, no shortcuts

Path 2: The Income Optimizer (Faster Timeline)

Who it’s for: Ambitious earners willing to push their income higher through career moves or side hustles

The strategy:

- Negotiate salary aggressively (15-30% jumps every 2-3 years)

- Build side income streams ($2-5K/month)

- Invest 30-50% of income instead of 10-20%

- Stack raises and side income into investments

Real example: Start at $70K salary, grow to $120K over 10 years through job changes. Add $3K/month side income. Invest $4,000/month total at 8% returns = $1M in 13 years.

Pros: Much faster, builds skills, multiple income streams Cons: More work, requires hustle, potential burnout

Path 3: The Business Builder (Highest Risk, Highest Reward)

Who it’s for: Entrepreneurs willing to bet on themselves and handle uncertainty

The strategy:

- Build a scalable business (service, product, or software)

- Reinvest profits to grow revenue

- Pay yourself strategically while building equity

- Exit via sale or build dividend-generating asset

Real example: Build a SaaS business over 5 years, grow to $500K/year profit, sell for 3-5x revenue = instant millionaire. Or keep it and pull $300K+/year in owner distributions.

Pros: Fastest path if it works, uncapped upside, equity ownership Cons: High failure rate, stressful, requires expertise and capital

Which path should you choose?

Most people use a hybrid: steady W-2 investing (Path 1) + side income optimization (Path 2). You get the stability of index funds plus the acceleration of extra income.

The business path (Path 3) is tempting but statistically risky. Only pursue it if you have skills, market knowledge, and stomach for volatility.

The Income Optimization Playbook: Earning More Matters

Here’s what nobody talks about: You can’t save your way to a million dollars on a $50K salary.

The math doesn’t work unless you live like a monk for 40 years.

But you can absolutely earn your way there by strategically growing your income over time. Here’s how:

Strategy 1: Master the Job-Hop Raise

Staying at the same company for 5+ years is loyalty. It’s also leaving money on the table.

Data: Employees who stay at a company longer than 2 years earn 50% less over their lifetime than those who change jobs.

The playbook:

- Every 2-3 years, update your resume

- Interview at 3-5 companies (even if you’re happy)

- Negotiate for 15-30% raises when switching

- Use competing offers as leverage

Real example:

- Year 0: $65K at Company A

- Year 2: Switch to Company B at $80K (+23%)

- Year 4: Switch to Company C at $100K (+25%)

- Year 7: Switch to Company D at $130K (+30%)

That’s $65K to $130K in 7 years—a 100% increase. Staying put would’ve gotten you maybe 3-5% annual raises ($75-80K after 7 years).

The delta? An extra $50K/year, every year. Invested, that’s millions.

Strategy 2: Build High-Income Skills

Not all skills pay the same. Some are worth $15/hour. Others are worth $150/hour.

High-ROI skills for 2026:

- Technical writing for SaaS companies ($75-150/hour)

- Google Ads/Facebook Ads management ($100-200/hour)

- Salesforce administration ($80-120/hour)

- Video editing for brands ($60-100/hour)

- Copywriting for e-commerce ($75-150/hour)

Pick one. Learn it deeply. Sell it as a freelance service while keeping your day job.

Even $2,000/month side income = $24,000/year. Invested over 20 years at 8%? That’s $1.2 million alone.

Strategy 3: Go Where the Money Is

Some industries just pay better. If you’re in a low-paying field and willing to pivot, consider:

High-paying industries (median salaries):

- Tech/Software: $90-150K

- Finance: $85-140K

- Real Estate Investment Trusts (REITs): $100-360K

- Healthcare (non-clinical roles): $75-120K

- Legal (paralegals, compliance): $70-110K

- Sales (B2B, SaaS): $80-200K+

Switching from retail management ($50K) to tech sales ($90K base + commission) can double your income overnight. That’s not exaggeration—I’ve seen it happen.

Want weekly wealth-building strategies delivered to your inbox?

Join readers getting practical investing and income optimization tips every Friday. No spam, unsubscribe anytime.

The Investment Strategy That Actually Works

Let’s talk about where to put the money you’re earning and saving.

The millionaire asset allocation isn’t complicated:

Core Holdings (80-90% of portfolio)

1. Total Stock Market Index Funds

- Examples: VTSAX (Vanguard), VTI (Vanguard ETF), FSKAX (Fidelity)

- What it is: Ownership of ~4,000 U.S. companies

- Historical return: ~10% annually over 30+ years

- Risk level: Medium (volatile short-term, reliable long-term)

This is your foundation. Boring, diversified, proven.

2. International Stock Index Funds

- Examples: VTIAX (Vanguard), VXUS (Vanguard ETF)

- What it is: Ownership of companies outside the U.S.

- Allocation: 10-30% of stock portfolio

- Why: Diversification across global markets

3. Bond Index Funds (Optional for those 10+ years from retirement)

- Examples: BND (Total Bond Market), VBTLX (Vanguard)

- What it is: Lower-risk fixed income

- Allocation: 10-30% depending on age and risk tolerance

- Why: Stability, reduces volatility

Satellite Holdings (10-20% for calculated risks)

1. Individual Growth Stocks

- High-conviction companies you believe in (Apple, Microsoft, Amazon, etc.)

- Risk: Higher volatility, potential for bigger gains/losses

- Rule: Never more than 5% of portfolio in a single stock

2. REITs (Real Estate Investment Trusts)

- Examples: VNQ (Vanguard Real Estate ETF), O (Realty Income)

- What it is: Real estate exposure without buying property

- Why: Diversification, dividend income

3. High-Yield Dividend Stocks

- Companies that pay consistent dividends (4-6%+ yields)

- Examples: AT&T, Verizon, energy companies

- Why: Passive income stream that compounds

What I actually do:

- 70% VTSAX (Total U.S. Stock Market)

- 15% VTIAX (International Stocks)

- 10% Individual stocks (tech companies I believe in)

- 5% REITs for diversification

That’s it. No crypto gambling. No meme stocks. No complex options strategies.

The contribution order that maximizes growth:

- Employer 401(k) up to match (free money, always take it)

- Max out Roth IRA ($7,000/year in 2026, or $8,000 if 50+)

- Max out HSA if eligible ($4,300/year individual, $8,550 family—triple tax advantaged)

- Max out 401(k) ($23,500/year in 2026, or $31,000 if 50+)

- Taxable brokerage account (everything beyond that)

Example: Making $100K/year, here’s a realistic millionaire-track allocation:

- 401(k): $23,500/year

- Roth IRA: $7,000/year

- HSA: $4,300/year

- Total invested: $34,800/year ($2,900/month)

At 8% returns, you hit $1 million in 18 years.

The Millionaire Savings Rate: How Much to Invest

“How much should I be saving?”

The answer depends on your timeline:

| Goal | Savings Rate Needed |

|---|---|

| Retire at 65 (normal) | 10-15% of income |

| Retire at 55 (early) | 25-35% of income |

| Retire at 45 (very early) | 50-60% of income |

| Become a millionaire by 40 (starting at 25) | 35-50% of income |

Reality check: Most Americans save less than 5% of their income. If you’re saving 15-20%, you’re already way ahead.

The 50/30/20 rule (modified for wealth builders):

- 50% needs (rent, food, insurance, bills)

- 20% wants (fun, travel, hobbies)

- 30% wealth building (investments, side business, education)

Notice I flipped the traditional 20% savings and 30% wants? That’s intentional. If you want to build wealth faster than average, you need to save more than average.

How to hit 30% savings on a $75K salary:

- Gross income: $75,000

- After taxes (~25%): $56,250

- Target savings (30% of gross): $22,500/year ($1,875/month)

- Spending budget: $33,750/year ($2,812/month)

Is it tight? Yes. Is it impossible? No. Millions of people do this.

If 30% feels impossible, start with 15% and increase 1% every year. In 5 years, you’re at 20%. In 10 years, you’re at 25%. The compounding effect of increasing your savings rate is massive.

The Wealth-Building Habits That Separate Millionaires From Everyone Else

Here’s what I learned studying actual millionaires (not Instagram fake gurus—real people with $1M+ verified net worth):

Habit 1: They Automate Everything

Millionaires don’t rely on willpower. They build systems.

What to automate:

- 401(k) contributions (directly from paycheck)

- Roth IRA deposits (auto-transfer on payday)

- Savings account transfers (out of sight, out of mind)

- Bill payments (never miss, never think about it)

Set it up once. Let it run for 30 years. That’s the entire strategy.

Habit 2: They Track Net Worth, Not Income

Making $150K means nothing if you spend $160K.

Net worth formula: (Assets: retirement accounts, investment accounts, real estate equity, cash) MINUS (Liabilities: mortgage, car loans, credit cards, student loans) = Net Worth

Track it monthly. Use a spreadsheet or tools like Personal Capital, Mint, or YNAB.

Watching your net worth go from $10K to $50K to $100K to $500K is motivating. It makes the sacrifices feel real.

Habit 3: They Avoid Lifestyle Inflation

You get a $20K raise. What do you do?

Most people: Upgrade apartment, lease a nicer car, eat out more. Net result: same savings rate, fancier life.

Millionaires: Invest the entire raise. Keep living on the old salary. Net result: wealth compounds faster.

The 50/50 rule: When you get a raise, invest 50%, enjoy 50%. You get to improve your lifestyle AND accelerate wealth.

Example:

- Salary increases from $80K to $100K (+$20K)

- Invest $10K of it (raises annual investing from $24K to $34K)

- Spend the other $10K on quality of life improvements

You’re still better off, but you’re not falling into the trap of lifestyle inflation.

Habit 4: They Invest Windfalls, Not Spend Them

Tax refund? Bonus? Inheritance? Gift?

Most people: Vacation, new TV, splurge purchases Millionaires: Straight into investments

A $5,000 bonus invested at age 30 becomes $54,000 by age 65 (8% return). Spent, it becomes zero.

Make a rule: 80% of windfalls go to investments. Enjoy 20%.

Habit 5: They Think in Decades, Not Days

Wealth building is a long game. Checking your portfolio daily is a recipe for panic and bad decisions.

The millionaire mindset:

- Ignore daily market swings

- Don’t panic sell in downturns

- Trust the 30-year trend (always up)

- Focus on contribution consistency, not timing

The S&P 500 has had positive returns in 70% of all years since 1950. But if you panic-sold during crashes, you missed the recoveries.

Stay the course. Boring wins.

The Millionaire Timeline: Real Scenarios Based on Income

Let’s make this concrete. Here’s what becoming a millionaire actually looks like for different income levels:

Scenario 1: Starting Salary $60K

Assumptions:

- Start investing at age 28

- Initial investment: $500/month (10% of income)

- Salary grows 4%/year

- Savings rate increases 1%/year

- 8% average annual return

Timeline:

- Age 35: $75K salary, $15K/month invested, $120K net worth

- Age 45: $110K salary, $2,000/month invested, $450K net worth

- Age 55: $160K salary, $2,800/month invested, $1.1M net worth

Result: Millionaire by 55 (27 years of investing)

Scenario 2: Starting Salary $90K

Assumptions:

- Start investing at age 30

- Initial investment: $1,200/month (16% of income)

- Salary grows 5%/year

- Savings rate increases 1%/year

- 8% average annual return

Timeline:

- Age 35: $115K salary, $1,800/month invested, $160K net worth

- Age 45: $185K salary, $3,500/month invested, $650K net worth

- Age 50: $235K salary, $4,500/month invested, $1.2M net worth

Result: Millionaire by 50 (20 years of investing)

Scenario 3: Starting Salary $120K

Assumptions:

- Start investing at age 32

- Initial investment: $2,000/month (20% of income)

- Salary grows 6%/year

- Savings rate increases 1%/year

- 8% average annual return

Timeline:

- Age 37: $160K salary, $3,000/month invested, $240K net worth

- Age 42: $215K salary, $4,500/month invested, $600K net worth

- Age 47: $285K salary, $6,000/month invested, $1.3M net worth

Result: Millionaire by 47 (15 years of investing)

Notice the pattern? Higher income gets you there faster, but even $60K can make you a millionaire if you’re patient and consistent.

What Could Go Wrong (And How to Handle It)

Let’s be honest: life doesn’t follow spreadsheets. Here’s what can derail your millionaire plan and how to prepare:

Risk 1: Market Crashes

What happens: Your $400K portfolio drops to $280K in a year

How to handle it:

- Don’t panic sell (this locks in losses)

- Keep investing through the dip (you’re buying stocks on sale)

- Remember: every crash in history has recovered

Historical truth: If you invested right before the 2008 crash and stayed invested, you were back to break-even by 2012 and way ahead by 2015.

Risk 2: Job Loss

What happens: You lose your income stream and can’t contribute to investments

How to handle it:

- Build a 6-month emergency fund BEFORE aggressive investing

- Keep skills updated so you’re always employable

- Have side income streams as backup

The rule: Never invest money you might need in the next 5 years. Investments are long-term, not emergency funds.

Risk 3: Health Crisis

What happens: Medical bills drain savings or prevent you from working

How to handle it:

- Max out HSA contributions (tax-free medical fund)

- Keep health insurance even if it’s expensive (bankruptcy from medical debt is real)

- Disability insurance if you’re high-income and can afford it

Risk 4: Divorce

What happens: You split assets 50/50, destroying years of wealth building

How to handle it:

- Prenups aren’t romantic, but they’re smart

- Keep investing even during/after divorce

- Don’t make emotional financial decisions

Truth bomb: Divorce is one of the biggest wealth destroyers. Protecting your assets isn’t pessimistic, it’s realistic.

The Boring Truth About Becoming a Millionaire

Here’s what this entire guide boils down to:

- Earn as much as you can (career growth, side income, skills)

- Save 20-40% of it (automate so you don’t think about it)

- Invest in index funds (boring, diversified, proven)

- Wait 15-30 years (compound growth does the heavy lifting)

- Don’t panic when markets drop (they always recover)

That’s it. That’s the whole strategy.

No crypto moonshots. No real estate empire. No viral side hustle. Just consistent earning, saving, and investing over decades.

Is it exciting? No. Does it work? Every single time.

The millionaires you see on Instagram flashing cars and watches? Most of them are broke or lying. The real millionaires are the ones you’d never guess—teachers who maxed out their 403(b) for 30 years, engineers who lived below their means and invested the rest, small business owners who reinvested profits instead of upgrading their lifestyle.

Becoming a millionaire isn’t about genius. It’s about discipline.

Your First Move: The 30-Day Millionaire Kickstart

You’ve got the roadmap. Here’s exactly what to do in the next 30 days:

Week 1: Calculate Your Starting Point

Tasks:

- Calculate your current net worth (assets minus debts)

- Review last 3 months of spending (where is your money actually going?)

- Determine your current savings rate (be honest)

- Set your millionaire timeline goal (when do you want to hit $1M?)

Week 2: Optimize Your Income

Tasks:

- Update your resume and LinkedIn profile

- Research salaries for your role (are you underpaid?)

- Identify 2-3 high-income skills you could learn

- Apply to 3 higher-paying jobs (even if you’re not ready to leave)

Week 3: Build Your Investment System

Tasks:

- Open a Roth IRA if you don’t have one (Vanguard, Fidelity, or Schwab)

- Increase 401(k) contribution by at least 1%

- Set up automatic monthly transfers to investment accounts

- Choose your index funds (VTSAX, VTI, or equivalent)

Week 4: Lock In the Habits

Tasks:

- Create a monthly net worth tracking spreadsheet

- Set calendar reminders to review investments quarterly (not daily)

- Join a wealth-building community (Reddit’s r/financialindependence, Bogleheads forum)

- Tell someone your millionaire goal (accountability matters)

30 days from now, you should have:

- A clear net worth number

- Automated investments running

- A plan to increase income

- Systems in place to stay consistent

That’s how millionaires are made. Not in a day. In thousands of small decisions compounded over decades.

Time to Stop Reading and Start Building

Look, I can’t make you a millionaire.

Only you can do that.

But here’s what I know: every person who’s hit $1 million in net worth started exactly where you are—zero, or negative, or some small number that felt impossibly far from a million.

They didn’t have a secret. They had a system.

You’ve got the roadmap now. The math is simple. The strategy is proven. The only question left is whether you’ll actually do it.

Start with $500/month. Or $1,000. Or whatever you can realistically commit to. Automate it. Forget about it. Check back in 5 years and watch the compounding magic happen.

Your future millionaire self is waiting. Don’t make them wait any longer.

Keep Building Your Wealth Strategy

Becoming a millionaire is step one. But what do you do with that wealth once you’ve built it?

Learn how to generate passive income with dividend stocks—the strategy that pays you every quarter whether you’re working or not.

Or if you’re ready to accelerate your income, freelance writing can add $2-4K/month to your investment budget without quitting your day job.

Wealth building is a system. Income optimization + smart investing + time = millionaire status. You’ve got this.

Disclaimer: This article is for educational purposes only and does not constitute financial advice. Investment returns are not guaranteed. Past performance does not predict future results. Consult a licensed financial advisor before making investment decisions.

Get Weekly Wealth Tips

Real strategies delivered every week. No fluff, just actionable tips to build wealth.

No spam. Unsubscribe anytime.